Buyer Profiles in Today’s Market

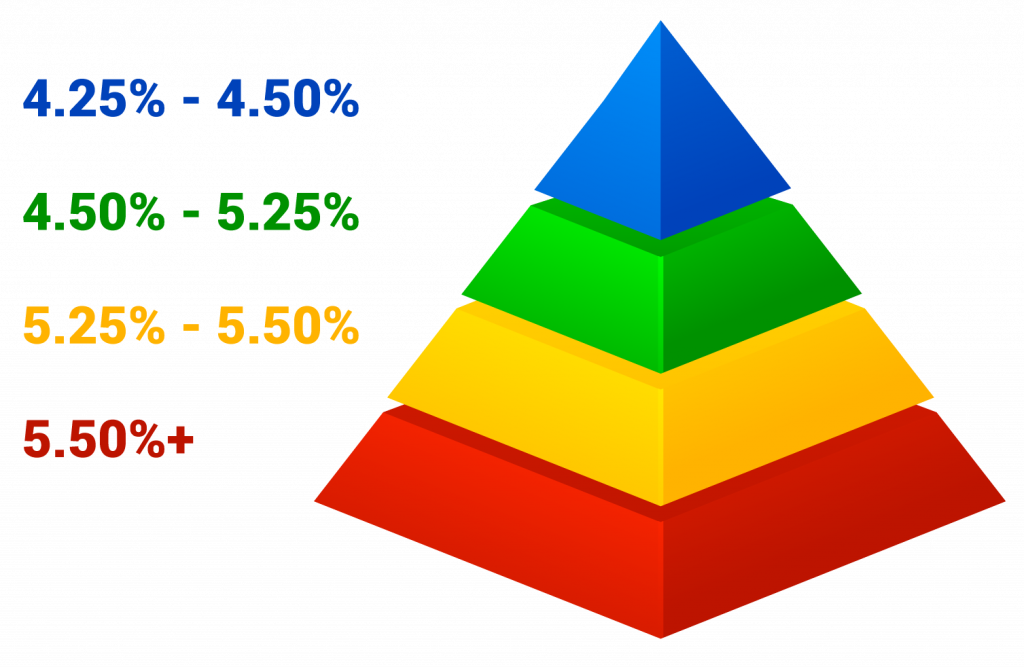

Buyer profiles for Walgreens, CVS and Rite Aid investment properties have remained fairly consistent over the past several years. In today’s market we see most drugstore Buyers falling into one of the following categories:

Best Real Estate

Willing to pay a premium CAP rate for the absolute best corner/location. These buyers are usually looking for a major metro market with strong density and high average household incomes. Fewer than 5% of buyers fall into this category.

Regional Real Estate

These buyers want a Walgreens, CVS or Rite Aid close to their home at a “market” CAP rate. Typically, these buyers are willing to pay slightly better CAP rates than market if they can find something in their backyard or a neighboring state.

Best Value Real Estate

Many buyers first look locally/regionally, but often expand their search geographically once a broker educates them on the Walgreens, CVS and Rite Aid market. These buyers are looking closely at balancing demographics, retail trade area, and underlying real estate value with a competitive market CAP rate.

National / Cap Rate Buyers

The vast majority of drugstore buyers in the market today view Walgreens, CVS and Rite Aid as a bond with a fixed yield and do not care much about location or underlying real estate value. These buyers are shopping only on CAP rate / yield. These buyers are operating under the assumption that they will just keep collecting the flat Walgreens, CVS or Rite Aid rent every month for 25 years plus 50 years of options. Many will use CTL debt with no demographic requirements and simply look for more spread for greater cash-on-cash return.

Our Recommendation

We are strong believers in pricing relative to your specific competition.

If you choose to compete nationally, you’ll need to meet or exceed the highest CAP rates to maximize exposure for your store and minimize marketing time.

That being said, proper pricing must be accompanied by a very targeted regional marketing push, as well as casting a wide net nationally.